In recent times, Grayscale, one of the largest cryptocurrency investment firms, has faced significant scrutiny surrounding its Bitcoin holdings. This article delves into the reasons behind Grayscale’s decision to sell BTC, the implications for investors, and the shifting landscape of digital asset management.

The Context of Grayscale’s Sales

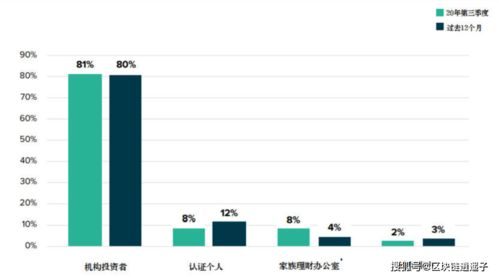

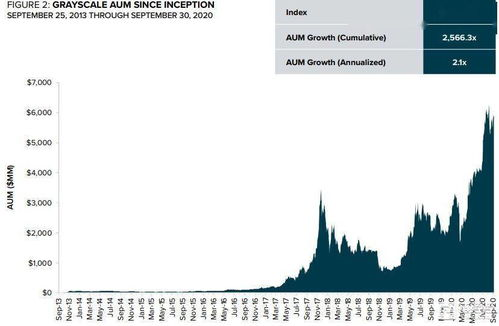

Grayscale’s Bitcoin Trust (GBTC) has been a prominent player in the crypto market, providing institutional investors access to Bitcoin without needing to purchase the asset directly. However, the dynamics of cryptocurrency investing have evolved, leading to an unexpected pivot in Grayscale’s strategy. The firm has started selling portions of its Bitcoin holdings, which raises questions among both retail and institutional investors.

Implications of Market Dynamics

The cryptocurrency market is notoriously volatile, and Grayscale’s decision to liquidate some Bitcoin assets may reflect broader market trends. Factors such as regulatory uncertainty, shifts in market demand, and changes in investor sentiment have influenced their strategic moves. By selling BTC, Grayscale aims to mitigate potential losses and reposition its portfolio in line with current market conditions. This reaction showcases the importance of adaptability in the fast-paced world of cryptocurrencies.

Investor Sentiment and Trust

Grayscale’s actions can also be perceived as a response to the evolving perceptions of Bitcoin among investors. Increased competition from other cryptocurrencies and investment vehicles may have prompted Grayscale to reassess its approach. As trust in Bitcoin wavers for some investors, the firm’s sales can be seen as a signal of caution, potentially impacting overall confidence in the cryptocurrency market.

The Future of Cryptocurrency Management

As Grayscale pivots its strategy, the future of cryptocurrency fund management is sure to be affected. The company’s decisions will likely inspire both competitors and regulators to rethink how digital assets are managed and traded. Grayscale’s actions may lead to the emergence of new investment strategies geared towards managing risk in a volatile market, fostering innovation within the industry.

In summary, Grayscale’s decision to sell Bitcoin is driven by market dynamics, adaptive strategies amidst volatility, and changing investor sentiments. As the crypto landscape continues to evolve, the choices made by significant players like Grayscale will be crucial in shaping the future of cryptocurrency investments.