In the world of cryptocurrency, the conversion of Bitcoin (BTC) to US dollars (USD) has become increasingly important for traders and investors alike. This article explores the current conversion rate, the significance of understanding Bitcoin’s value in USD, and strategies for navigating this dynamic currency exchange.

Current Bitcoin Value in USD

As of the latest market data, the conversion of Bitcoin to US dollars can vary based on market fluctuations. For example, at a rate of

$24,000 per BTC, 0.00000207 BTC would equate to approximately $0.00004968 USD. This highlights a minuscule investment that represents the fractional nature of Bitcoin transactions, where even the smallest amounts can hold value.

Understanding the current value of BTC in USD is crucial for making informed trading decisions. Cryptocurrency prices can change rapidly, and being able to quickly convert BTC to USD allows investors to capitalize on these fluctuations effectively. Keeping track of market trends and conversion rates is key in this volatile environment.

Factors Influencing Bitcoin Valuation

Several factors play a role in the valuation of Bitcoin against the US dollar. Supply and demand is the fundamental principle affecting Bitcoin’s price. As more individuals and institutions adopt Bitcoin, the demand increases, often driving the price higher. Conversely, a decrease in demand can lead to price drops.

Another significant factor is regulatory news. Government regulations in key markets can influence the overall crypto market sentiment. Positive regulations can attract more investors, consequently increasing the Bitcoin price, whereas restrictive regulations can produce the opposite effect.

Market sentiment and trends also affect Bitcoin’s value. Social media trends, significant purchases by corporations, or endorsements from influential figures can shift public perception about Bitcoin and, as a result, its price in USD.

Strategies for Bitcoin to USD Transactions

For those looking to convert their Bitcoin into US dollars, there are several strategies to consider. First, utilizing cryptocurrency exchanges is a common method. Platforms like Coinbase, Binance, or Kraken offer straightforward processes for buying and selling BTC. Investors should compare fees and services to find the most suitable exchange.

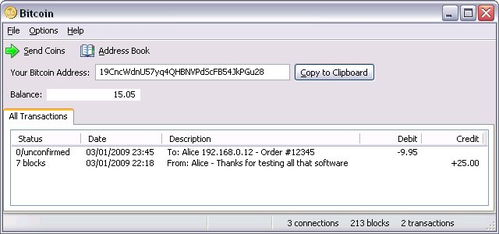

Another strategy includes using wallets that support BTC to USD conversions. Some digital wallets provide integrated features for direct conversion or alerts when BTC reaches a specified value in USD, allowing investors to make timely decisions.

Lastly, consider the timing of conversions. Monitoring the market for peak times to convert Bitcoin when prices are high can lead to more profitable transactions. Employing techniques like dollar-cost averaging when investing in Bitcoin can also help manage risks associated with price volatility.

In summary, the conversion rate of Bitcoin to US dollars is a vital aspect for investors navigating the cryptocurrency landscape. Understanding current values, factors that influence market prices, and strategic approaches for transactions can significantly enhance investment outcomes. It is essential to stay informed and vigilant as the market evolves rapidly.