90 Ton Gold Price: A Comprehensive Guide

Are you intrigued by the concept of 90 ton gold price? If so, you’ve come to the right place. In this detailed guide, we will delve into the various aspects of this intriguing topic. From the current market value to the factors that influence it, we will cover it all. So, let’s get started.

Understanding the Concept

Before we dive into the specifics, let’s first understand what 90 ton gold price actually means. The term refers to the price of gold that would be obtained if you were to sell 90 metric tons of gold. This is a significant amount, and the price can vary greatly depending on various factors.

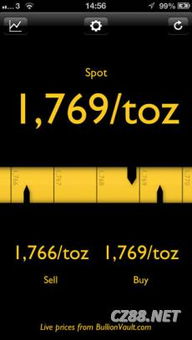

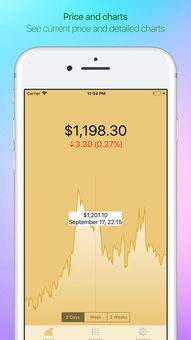

Current Market Value

As of the latest available data, the 90 ton gold price is approximately $1.2 billion. This figure is subject to change daily, as the gold market is highly volatile. To get the most accurate and up-to-date information, it is essential to consult reliable sources.

Factors Influencing the Price

Several factors can influence the 90 ton gold price. Here are some of the key factors to consider:

-

Supply and Demand: The basic principle of supply and demand plays a crucial role in determining the price of gold. If the demand for gold increases, the price tends to rise, and vice versa.

-

Economic Factors: Economic conditions, such as inflation, interest rates, and currency fluctuations, can significantly impact the gold market.

-

Geopolitical Events: Political instability, conflicts, and other geopolitical events can lead to increased demand for gold as a safe-haven investment.

-

Technological Advancements: Innovations in mining and refining processes can affect the supply of gold, thereby influencing its price.

Historical Price Trends

Looking at historical data, we can observe some interesting trends in the 90 ton gold price. Over the past few decades, the price has experienced both highs and lows. For instance, in 1980, the price reached an all-time high of $850 per ounce. However, in the early 2000s, it plummeted to around $250 per ounce. Since then, it has been on an upward trend, reaching its current level.

Comparing with Other Precious Metals

When comparing the 90 ton gold price with other precious metals, such as silver and platinum, we can see some interesting differences. Gold is generally considered the safest investment among these metals, and its price tends to be higher. However, the price of silver and platinum can also be influenced by similar factors as gold.

Investing in Gold

Investing in gold can be a wise decision, especially during times of economic uncertainty. Here are some tips for investing in gold:

-

Research: Conduct thorough research to understand the market and its trends.

-

Diversify: Diversify your investment portfolio to mitigate risks.

-

Stay Informed: Keep yourself updated with the latest market news and developments.

-

Consult Experts: Seek advice from financial experts before making any investment decisions.

Conclusion

In conclusion, the 90 ton gold price is a significant figure in the gold market. Understanding the factors that influence it and staying informed about the market trends can help you make informed investment decisions. Remember, investing in gold should be done with careful consideration and research.

| Year | 90 Ton Gold Price (USD) |

|---|---|

| 1980 | $850 |

| 2000 | $250 |

| 2021 | $1.2 billion |