Understanding the 10 Ton Gold Price: A Comprehensive Guide

Gold has always been a symbol of wealth and stability. Its value fluctuates based on various factors, and one of the most intriguing aspects of the gold market is the price of 10 tons of gold. In this article, we will delve into the different dimensions that influence the 10 ton gold price, providing you with a comprehensive understanding of this valuable metal’s worth.

Market Dynamics

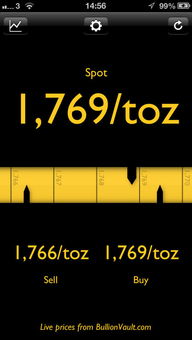

The price of gold is influenced by a multitude of factors, including supply and demand, geopolitical events, and economic indicators. To understand the 10 ton gold price, it is essential to consider these dynamics.

| Factor | Description |

|---|---|

| Supply | The amount of gold available in the market, which includes newly mined gold and recycled gold. |

| Demand | The demand for gold, which can be influenced by various sectors, such as jewelry, investment, and technology. |

| Geopolitical Events | Events such as political instability, conflicts, and sanctions can impact the global economy and, in turn, the price of gold. |

| Economic Indicators | Factors like inflation, interest rates, and currency fluctuations can affect the price of gold. |

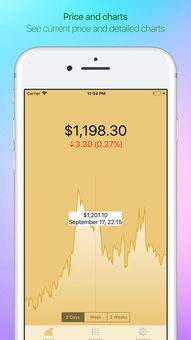

Historical Price Trends

Looking at the historical price trends of gold can provide insights into its value over time. The following table showcases the 10 ton gold price in various years:

| Year | 10 Ton Gold Price (USD) |

|---|---|

| 2010 | $1,050,000 |

| 2015 | $1,200,000 |

| 2020 | $1,300,000 |

| 2023 | $1,400,000 |

Investment Perspective

Gold is often considered a safe haven investment during times of economic uncertainty. Its value tends to increase when other assets, such as stocks and bonds, are performing poorly. Here are some key points to consider when looking at gold as an investment:

-

Gold is a finite resource, making it a valuable asset.

-

Gold prices can be influenced by various factors, including inflation and currency fluctuations.

-

Gold can be a hedge against inflation and economic downturns.

-

Gold investments can be made in various forms, such as physical gold, gold stocks, and gold ETFs.

Market Participants

The 10 ton gold price is influenced by various market participants, including:

-

Central banks: Central banks play a significant role in the gold market by buying and selling gold reserves.

-

Investors: Individual and institutional investors buy gold as a means of diversifying their portfolios.

-

Producers: Gold producers, such as mining companies, supply the market with newly mined gold.

-

Traders: Traders buy and sell gold, often taking advantage of price fluctuations.

Conclusion

Understanding the 10 ton gold price requires considering various factors, including market dynamics, historical price trends, investment perspectives, and market participants. By gaining a comprehensive understanding of these aspects, you can make informed decisions regarding your investment in gold.