Cpo Price USD Ton Graph: A Comprehensive Overview

Understanding the market trends and fluctuations of commodities is crucial for investors and traders. One such commodity that has gained significant attention is CPO, or Crude Palm Oil. In this article, we will delve into the CPO price USD ton graph, providing you with a detailed and multi-dimensional analysis of this vital commodity.

What is Crude Palm Oil (CPO)?

Crude Palm Oil is a vegetable oil derived from the fruit of the oil palm tree. It is widely used in the food, cosmetic, and biofuel industries. The production of CPO is primarily concentrated in countries like Indonesia, Malaysia, and Thailand, making it one of the most traded agricultural commodities globally.

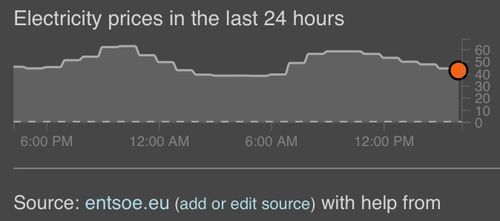

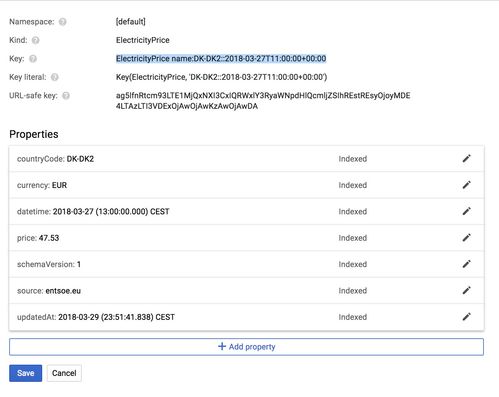

Understanding the CPO Price USD Ton Graph

The CPO price USD ton graph is a visual representation of the price of CPO in US dollars per metric ton over a specific period. This graph provides valuable insights into the market dynamics and helps traders and investors make informed decisions.

Let’s explore the key aspects of the CPO price USD ton graph:

Market Trends

Over the years, the CPO price USD ton graph has shown a significant upward trend. This can be attributed to various factors, including increasing global demand, favorable weather conditions, and favorable government policies. However, it is essential to analyze the graph to identify any patterns or anomalies that may affect future prices.

Seasonal Variations

Seasonal variations play a crucial role in the CPO market. The graph often shows higher prices during the peak production seasons in Indonesia and Malaysia, which are typically from May to September. Conversely, prices tend to be lower during the off-season, from October to April.

Impact of Global Events

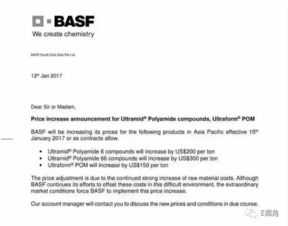

Global events, such as political instability, trade disputes, and natural disasters, can have a significant impact on the CPO price USD ton graph. For instance, the palm oil industry in Indonesia and Malaysia has faced challenges due to environmental concerns and labor issues, leading to fluctuations in prices.

Commodity Correlation

The CPO price USD ton graph is often correlated with other commodities, such as soybean oil and sunflower oil. Traders and investors closely monitor these correlations to gain insights into the overall market sentiment and make informed decisions.

Technological Advancements

Technological advancements in the palm oil industry have also influenced the CPO price USD ton graph. Improved harvesting techniques, better yield management, and sustainable practices have contributed to increased production, which can affect prices.

Government Policies

Government policies, particularly in major producing countries, play a crucial role in shaping the CPO price USD ton graph. Policies related to import/export restrictions, subsidies, and environmental regulations can significantly impact the market dynamics.

Conclusion

Understanding the CPO price USD ton graph is essential for anyone interested in the palm oil market. By analyzing the graph, you can gain insights into market trends, seasonal variations, global events, commodity correlations, technological advancements, and government policies. This comprehensive overview will help you make informed decisions and stay ahead in the competitive CPO market.

| Factor | Description |

|---|---|

| Market Trends | Long-term upward trend in CPO prices |

| Seasonal Variations | Higher prices during peak production seasons |

| Global Events | Political instability and trade disputes impact prices |

| Commodity Correlation | Correlation with soybean oil and sunflower oil |

| Technological Advancements | Improved production techniques affect prices |

| Government Policies | Import/export restrictions and environmental regulations |