Understanding the $100 Ton Gold Price: A Comprehensive Guide

Gold has been a symbol of wealth and stability for centuries. Its value is often measured in terms of price per ounce, but what if we were to talk about the price of gold in a different, more massive scale? Imagine the price of 100 tons of gold. This article delves into the various aspects that contribute to this figure, providing you with a comprehensive understanding of the $100 ton gold price.

What is the Price of 100 Tons of Gold?

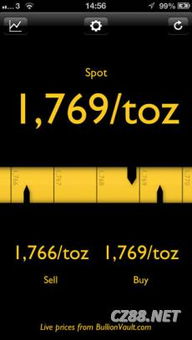

The price of 100 tons of gold can be calculated by multiplying the price per ounce by the total number of ounces in 100 tons. As of the latest available data, the price of gold per ounce is approximately $1,800. Therefore, the price of 100 tons of gold would be approximately $180 million.

| Weight of Gold | Price per Ounce | Total Price |

|---|---|---|

| 100 tons | $1,800 | $180,000,000 |

Factors Influencing the Price of Gold

The price of gold is influenced by various factors, both economic and geopolitical. Here are some of the key factors that contribute to the price of gold:

-

Economic Factors:

-

Inflation:

Gold is often seen as a hedge against inflation. When the value of the currency decreases, investors tend to turn to gold as a safe haven, driving up its price.

-

Economic Growth:

Gold prices can also be affected by economic growth. In times of strong economic growth, investors may be more inclined to invest in stocks and other assets, leading to a decrease in gold demand and a potential drop in its price.

-

-

Geopolitical Factors:

-

Political Instability:

Political instability in major economies can lead to increased demand for gold as investors seek a safe haven. This can drive up the price of gold.

-

Currency Fluctuations:

Gold is often priced in U.S. dollars. Fluctuations in the value of the dollar can impact the price of gold. A weaker dollar can make gold more expensive in other currencies, increasing its demand and potentially driving up its price.

-

-

Supply and Demand:

The balance between gold supply and demand is a crucial factor in determining its price. If the supply of gold is low and demand is high, the price will likely increase.

-

Market Speculation:

Investors often speculate on the future price of gold, which can cause short-term fluctuations in its value.

Historical Price of Gold

Over the years, the price of gold has fluctuated significantly. Here’s a brief overview of some key historical price points:

| Year | Price per Ounce (USD) |

|---|---|

| 1971 | $35 |

| 1980 | $850 |

| 2000 | $275 |

| 2020 | $1,800 |

Investing in Gold

Investing in gold can be a way to diversify your portfolio and protect against economic uncertainty. Here are some common ways to invest in gold:

-

Physical Gold:

Investing in physical gold, such as gold coins or bars, can be a direct way to own gold. However, it requires storage and insurance, which can add to the cost.

-