Lithium Price Per Metric Ton: A Comprehensive Overview

Understanding the price of lithium per metric ton is crucial for those involved in the battery industry, electric vehicle manufacturing, and other sectors that rely on this vital metal. The price of lithium can fluctuate significantly due to various factors, including supply and demand dynamics, geopolitical events, and technological advancements. Let’s delve into the details of lithium pricing and its impact on different industries.

Market Dynamics

The global lithium market has seen substantial growth in recent years, driven by the increasing demand for electric vehicles (EVs) and energy storage solutions. As a result, the price of lithium has experienced a notable upward trend. According to a report by Benchmark Mineral Intelligence, the average price of lithium carbonate (the most commonly used lithium compound) was around $12,000 per metric ton in 2020. However, this figure can vary significantly depending on the specific grade and form of lithium.

Supply and Demand Factors

Supply and demand dynamics play a crucial role in determining the price of lithium. The primary sources of lithium are brine deposits, hard rock mines, and clay deposits. The largest lithium-producing countries include Chile, Argentina, Australia, and China. Here are some key factors influencing supply and demand:

- Supply:

- Brine deposits: These are the most common source of lithium, accounting for approximately 60% of global production. The largest brine deposits are located in Chile and Argentina.

- Hard rock mines: These mines account for about 40% of global production and are primarily located in Australia, Bolivia, and China.

- Clay deposits: These deposits are less common and are found in countries like Brazil and Zimbabwe.

- Demand:

- Electric vehicles: The growing popularity of EVs has been the primary driver of increased lithium demand. According to the International Energy Agency (IEA), global EV sales reached 6.6 million units in 2020, up from 3.1 million in 2019.

- Energy storage: The demand for lithium-ion batteries for energy storage solutions has also been on the rise, driven by the need for renewable energy integration and grid stability.

- Other applications: Lithium is also used in various other applications, including glass, ceramics, and lubricants.

Geopolitical Events

Geopolitical events can have a significant impact on the price of lithium. For example, in 2019, a labor strike at the world’s largest lithium mine in Argentina caused a temporary supply disruption, leading to a surge in lithium prices. Similarly, tensions between the United States and China have raised concerns about the security of lithium supply chains, which can also influence prices.

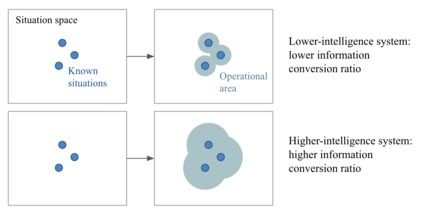

Technological Advancements

Technological advancements in lithium extraction and processing can also affect prices. For instance, the development of new techniques for extracting lithium from brine deposits has the potential to increase supply and lower prices. Additionally, improvements in battery technology, such as higher energy density and longer lifespan, can also impact demand and pricing.

Price Variations by Grade and Form

The price of lithium can vary significantly depending on the grade and form of the compound. Here’s a breakdown of some common lithium compounds and their average prices per metric ton:

| Lithium Compound | Average Price (USD) |

|---|---|

| Lithium Carbonate (99.5% purity) | $12,000 |

| Lithium Hydroxide (99.5% purity) | $13,000 |

| Lithium Iron Phosphate (LFP) | $8,000 |

| Lithium Manganese Dioxide (LMO) | $9,000 |

It’s important to note that these prices are subject to change and can vary based on market conditions, supplier, and other factors.

Impact on Industries

The price of lithium has a significant impact on various industries, including:

- Battery