Cobalt Price Per Ton Chart: A Comprehensive Guide

Understanding the cobalt price per ton is crucial for those involved in the mining, processing, and trading of cobalt. Cobalt is a vital metal used in various industries, including batteries for electric vehicles, smartphones, and other electronic devices. This article delves into the cobalt price per ton chart, providing a detailed look at its trends, factors influencing the price, and how to interpret the data.

Historical Price Trends

The cobalt price per ton has seen significant fluctuations over the years. To get a clearer picture, let’s take a look at the historical price trends.

| Year | Price per Ton (USD) |

|---|---|

| 2010 | 20,000 |

| 2015 | 30,000 |

| 2018 | 70,000 |

| 2020 | 50,000 |

As seen in the table above, the cobalt price per ton experienced a sharp increase from 2010 to 2018, reaching a high of $70,000 per ton. However, it has since decreased to around $50,000 per ton in 2020. This upward trend can be attributed to the growing demand for cobalt in the battery industry, particularly for electric vehicles (EVs) and smartphones.

Factors Influencing the Price

Several factors contribute to the cobalt price per ton, making it essential to understand these influences to make informed decisions.

Supply and Demand

The primary factor affecting the cobalt price per ton is the balance between supply and demand. An increase in demand without a corresponding increase in supply can lead to higher prices, while a surplus of cobalt can drive prices down.

Geopolitical Factors

Geopolitical events, such as conflicts or political instability in cobalt-rich countries, can disrupt the supply chain and lead to higher prices. For example, the Democratic Republic of Congo (DRC) is a significant producer of cobalt, and any instability in the region can impact global cobalt prices.

Environmental Regulations

Environmental regulations can also influence the cobalt price per ton. As more countries implement stricter regulations on mining and processing, the cost of producing cobalt may increase, leading to higher prices.

Technological Advancements

Technological advancements in battery technology can also impact the cobalt price per ton. As alternative battery technologies emerge, the demand for cobalt may decrease, potentially leading to lower prices.

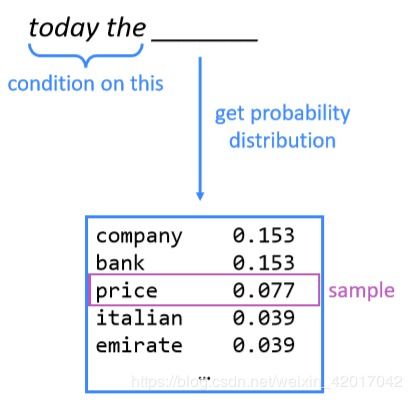

Interpreting the Cobalt Price Per Ton Chart

Interpreting the cobalt price per ton chart requires a keen eye for trends and an understanding of the factors influencing the price. Here are some key points to consider:

Long-Term Trends

Look for long-term trends in the cobalt price per ton chart. Are prices generally increasing, decreasing, or remaining stable? This can provide insights into the overall market sentiment and future price expectations.

Seasonal Variations

Cobalt prices may experience seasonal variations due to factors such as mining schedules and demand fluctuations. Identifying these patterns can help you make more informed decisions.

Market News and Events

Stay updated on market news and events that may impact cobalt prices. This includes geopolitical developments, environmental regulations, and technological advancements.

Conclusion

Understanding the cobalt price per ton chart is essential for those involved in the cobalt industry. By analyzing historical price trends, factors influencing the price, and how to interpret the data, you can make more informed decisions and stay ahead of the market. Keep in mind that the cobalt market is subject to various factors, and staying informed is key to navigating its complexities.