This article aims to provide an in-depth overview of Bitcoin, the leading cryptocurrency, covering its definition, how it works, investment strategies, and trading insights for both beginners and experienced investors.

An Understanding of Bitcoin

Bitcoin, often referred to as digital gold, is a decentralized digital currency that enables peer-to-peer transactions without the need for intermediaries like banks. Introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, Bitcoin operates on a technology called blockchain, which is a public ledger that records all transactions made with the currency. This groundbreaking invention not only fosters transparency but also enhances security, making Bitcoin one of the most sought-after digital assets.

How Bitcoin Works

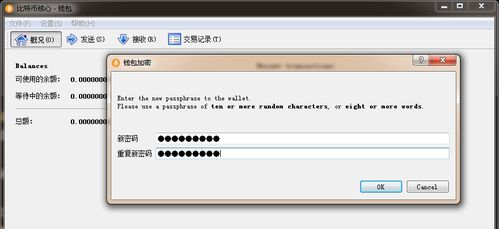

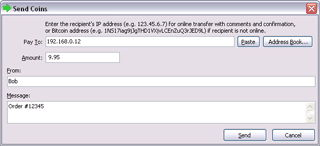

The transaction process of Bitcoin is quite straightforward. Users send and receive Bitcoin through a digital wallet and can access their assets using private keys. Each transaction is verified by miners, who use powerful computers to solve complex mathematical problems that secure the network. Upon solving these problems, miners are rewarded with newly created Bitcoins, and the completed transaction is added to the blockchain.

Investing in Bitcoin

Investing in Bitcoin has gained considerable popularity, particularly due to its potential for high returns and the increasing adoption of cryptocurrencies. Here are some strategies to consider:

- Long-term Holding (HODL) – Many investors buy and hold Bitcoin for the long term, believing that its price will increase significantly over the years.

- Dollar-Cost Averaging – This strategy involves investing a fixed amount of money in Bitcoin at regular intervals, regardless of the price, to minimize the impact of market volatility.

- Segmentation of Investment – Consider diversifying your investment across various cryptocurrencies besides Bitcoin, to balance risk and reward effectively.

Trading Bitcoin

Trading Bitcoin can be lucrative but comes with its own set of challenges. As the market for Bitcoin is highly volatile, traders often employ strategies based on technical analysis and market indicators. Here are some useful tips for trading Bitcoin:

- Stay Informed – Regularly check market trends and news that can influence Bitcoin’s price.

- Use Stop-Loss Orders – To mitigate losses, utilize stop-loss orders that automatically sell your Bitcoin when it reaches a pre-determined price.

- Leverage Trading – If you’re experienced, consider leverage trading for potential higher returns, but be aware that this increases risk.

In conclusion, Bitcoin is not just a digital currency; it represents a revolutionary shift in how we perceive and conduct financial transactions. Whether you choose to invest for the long term or trade actively, understanding its underlying mechanics and keeping up with the latest developments is crucial for success in this exciting but volatile space.