In this article, we will explore the crucial information regarding the Bitcoin ETF ticker, providing a comprehensive guide for potential investors and an overview of market implications. Understanding what a Bitcoin ETF (Exchange-Traded Fund) is and how it functions is vital for making informed investment decisions in the cryptocurrency space.

Understanding Bitcoin ETFs

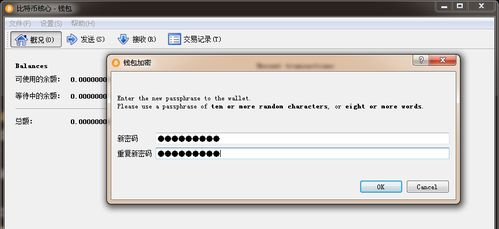

A Bitcoin ETF is a fund that tracks the price of Bitcoin, allowing investors to buy into the fund instead of directly purchasing Bitcoin itself. This provides a way for traditional investors to gain exposure to Bitcoin without needing to manage the complexities of owning and securing cryptocurrencies. The investment vehicle is traded on stock exchanges, making it accessible and straightforward for those familiar with conventional stocks and ETFs.

The ticker associated with a Bitcoin ETF is unique to each fund and often reflects the name of the ETF provider. For example, if an ETF is launched by a specific asset management company, the ticker might include abbreviations that relate to that company’s brand or the focus on Bitcoin. Tickers can provide insights into the trading volume, price trends, and overall behavior of the fund in the market.

Benefits of Investing in Bitcoin ETFs

Investors considering a Bitcoin ETF may find several advantages. Firstly, ETFs provide a regulated investment framework, which can alleviate some concerns regarding the legitimacy and security of the investment. Rather than trading on cryptocurrency exchanges, which can be volatile and less regulated, a Bitcoin ETF trades on established stock exchanges.

Investors also benefit from diversification opportunities. Instead of holding only Bitcoin, a Bitcoin ETF might include a portfolio of other correlated assets, which can mitigate risks associated with direct cryptocurrency investments. Additionally, for those concerned about the technical aspects of owning Bitcoin, an ETF simplifies the process by handling custody and transaction management on behalf of investors.

Market Insights and Performance Indicators

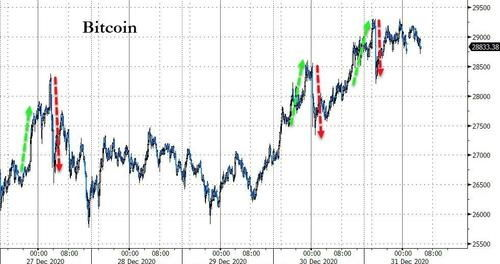

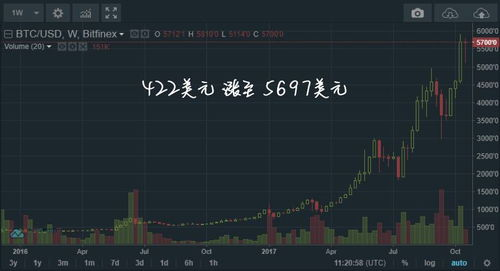

Analyzing a Bitcoin ETF’s ticker can yield valuable market insights. Investors can utilize the ticker symbol to track performance metrics, including historical prices, trading volume, and price volatility. Patterns observed in ticker trends may assist investors in making informed decisions about when to enter or exit their investments.

Furthermore, understanding how Bitcoin ETFs correlate with the broader cryptocurrency market can enhance investment strategies. Institutions and retail investors alike watch Bitcoin ETF tickers closely, as they often act as a barometer for sentiment within the crypto economy.

In conclusion, the Bitcoin ETF ticker serves not only as a simple identifier for trading but also as a gateway for investors to engage with the evolving landscape of cryptocurrency investments. By understanding its functionality and benefits, investors can better navigate the complexities of Bitcoin investments, making informed choices in a fast-paced market.