Investing in Bitcoin has become increasingly popular, especially for those looking to capitalize on the potential high returns of cryptocurrency. With a starting capital of $1

000, there are various strategies, tips, and risks to consider to make informed decisions in the Bitcoin market.

Understanding Bitcoin

Bitcoin, a decentralized digital currency, has gained immense popularity since its inception in 2009. As an innovative form of currency, it operates on a technology called blockchain, which ensures secure and transparent transactions. Investing in Bitcoin can be an appealing option for those who are looking to diversify their investment portfolios or seek significant returns on investment.

Investment Strategies for $1000

When investing $1000 in Bitcoin, several strategies can be implemented to maximize potential returns while minimizing risks. The following strategies are commonly employed by investors:

1. Dollar-Cost Averaging: This strategy involves investing a fixed amount, such as $1

000, over a period of time rather than all at once. For instance, you might choose to invest $200 weekly over five weeks. This allows you to buy Bitcoin at various prices, reducing the impact of volatility.

2. Long-Term Holding: Known as “HODLing,” this method entails buying Bitcoin and holding onto it for an extended period, regardless of market fluctuations. This strategy is based on the belief that Bitcoin will appreciate significantly over time, making it a worthwhile investment.

3. Active Trading: If you are more experienced, you might consider active trading. This involves buying and selling Bitcoin based on market trends and technical analysis. While it has the potential for higher returns, it also comes with increased risk and requires close monitoring of the market.

Essential Tips for Bitcoin Investors

To enhance your chances of success while investing in Bitcoin, consider the following tips:

– Do Your Research: Before investing, it is crucial to understand the market dynamics, Bitcoin’s historical performance, and news affecting its value.

– Use Reputable Exchanges: Choose reputable and secure cryptocurrency exchanges for your transactions. Always check security features and user reviews.

– Set Clear Goals: Establish your investment objectives, whether they are long-term growth, short-term profits, or diversification of your portfolio. This will guide your decision-making process.

Understanding Risks Involved

Despite the potential for high returns, investing in Bitcoin comes with significant risks:

– Market Volatility: The Bitcoin market is known for its volatility, with prices fluctuating dramatically within short periods, potentially leading to losses.

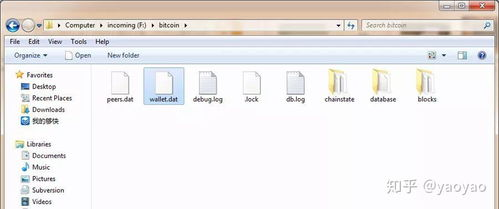

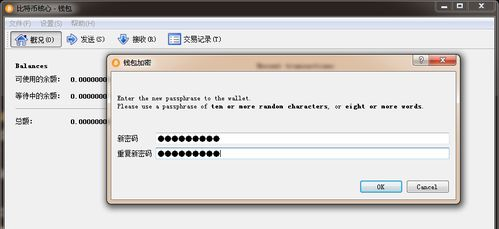

– Security Threats: Cryptocurrency exchanges can be susceptible to hacking. Ensuring the use of secure wallets and two-factor authentication can help mitigate risks.

– Regulatory Uncertainty: Cryptocurrency regulations continue to evolve globally, leading to potential impacts on Bitcoin’s value and market accessibility. It is essential to stay informed of regulatory changes.

In summary, investing $1000 in Bitcoin can be an effective way to enter the world of cryptocurrency, provided that investors utilize appropriate strategies, remain aware of key risks, and continuously educate themselves. By considering these factors, individuals can enhance their likelihood of achieving favorable outcomes in their Bitcoin investments.