In the world of cryptocurrency, Bitcoin stands as the most recognized and influential player. Its performance greatly impacts market trends, investment strategies, and financial forecasts. This article delves into the current status of Bitcoin, analyzes recent trends, and discusses potential future directions to help investors make informed decisions.

Understanding Bitcoin’s Market Position

Bitcoin, often referred to as BTC, has consistently shown its dominance in the cryptocurrency market. As the first digital currency, it has set numerous records for market capitalization and trading volumes. With various actors participating in the crypto space, Bitcoin’s position serves as a barometer for overall market sentiment. Investors closely monitor BTC trends as they can provide insights into the health of the broader cryptocurrency ecosystem.

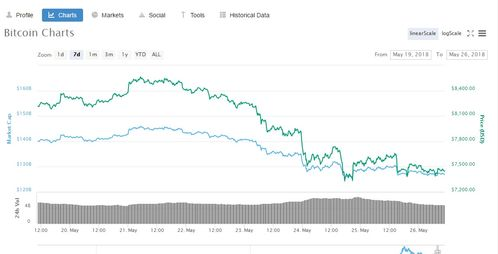

Recently, the market has witnessed fluctuating BTC prices, driven by factors like regulatory news, institutional adoption, and macroeconomic conditions. The growing interest from institutional investors indicates a shift toward acceptance, signaling the currency’s growing legitimacy and stability.

Market Trends Influencing Bitcoin’s Performance

In evaluating BTC performance, several trends come into play. These include market sentiment, technological advancements, and regulatory frameworks. Market sentiment plays a crucial role in shaping trading behavior, with price movements often reflecting public opinion and speculative activities. Social media and news reports can sway sentiment, leading to rapid price changes.

Technological developments within the Bitcoin network also significantly influence its performance. Innovations such as the Lightning Network aim to enhance transaction speeds and reduce costs. By improving accessibility and efficiency, such improvements may attract more users and investors, thus supporting price stability and growth.

Regulatory developments around Bitcoin are equally important. As more countries explore the possibility of legal measures regarding cryptocurrencies, the landscape changes dramatically. Clear and supportive regulations may foster growth, while restrictive measures could dampen enthusiasm.

Future Outlook for Bitcoin

Looking ahead, the future of Bitcoin remains a topic of much discussion. Various experts and analysts propose different scenarios. Adoption by major financial institutions and the progression of blockchain technology could drive demand for BTC, possibly pushing prices higher.

However, challenges remain. Market volatility, regulatory changes, and technological issues present ongoing risks. Investors are advised to remain vigilant and stay informed about market trends, as these factors will continue to shape Bitcoin’s financial landscape.

In conclusion, Bitcoin continues to assert its primacy in the cryptocurrency market, with its performance influencing broader trends and sentiment. By understanding the various factors that impact BTC, investors can better navigate this dynamic space and make more informed decisions regarding their investments. With a focus on technological advancements and regulatory developments, the future of Bitcoin may hold lucrative opportunities alongside inherent risks.