In this article, we will explore the value of Bitcoin, current exchange rates, and its investment potential, particularly focusing on how small fractions of Bitcoin are significant in today’s financial landscape.

The Significance of Bitcoin Value

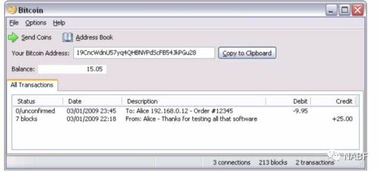

Bitcoin, often referred to as a digital currency or cryptocurrency, has gained immense popularity across the globe. The value of Bitcoin can fluctuate dramatically due to market demand, technological advancements, and regulatory news. As of now, even a fraction such as 0.00000223 BTC holds monetary value and represents a stake in this innovative form of currency.

An essential aspect of Bitcoin’s appeal is its decentralized nature, which makes it resistant to censorship and government intervention. This property is highly attractive for many investors, generating a broader acceptance of Bitcoin as a digital asset class.

Understanding Bitcoin Exchange Rates

The Bitcoin exchange rate is the price at which it can be exchanged for fiat currency, such as the US dollar. For example, if one Bitcoin is valued at

$50,

000, the fraction 0.00000223 BTC would equate to approximately $0.0001115. These rates change frequently, influenced by a variety of factors, including market sentiment and economic reports.

Notably, several cryptocurrency exchanges, such as Coinbase, Binance, and Kraken, facilitate these transactions, allowing users to buy, sell, and trade Bitcoin quickly and efficiently. Understanding how these exchanges attribute value to fractions of Bitcoin is crucial for potential investors.

Investment Potential in Bitcoin

Investing in Bitcoin, even in small amounts like 0.00000223 BTC, can be compelling for many. The potential for high returns, coupled with the growth trajectory of Bitcoin, has captured the attention of individual and institutional investors alike. When considering the volatility of cryptocurrencies, investors should approach with caution and conduct thorough market research.

Moreover, accumulating Bitcoin over time, even in tiny fractions, can lead to significant gains, especially as adoption grows. Dollar-cost averaging, which involves regularly buying a fixed dollar amount of Bitcoin, is a popular strategy for investors to accumulate more BTC over time without the stress of market timing.

In conclusion, the evaluation of Bitcoin value, the dynamics of exchange rates, and the investment potential, even with minimal fractions such as 0.00000223 BTC, reveal a complex and promising financial opportunity. As the landscape of cryptocurrency continues to evolve, understanding these basics will empower investors to make informed decisions.