Copper futures price per ton: A Comprehensive Overview

Understanding the copper futures price per ton is crucial for investors, traders, and businesses alike. Copper, as a fundamental commodity, plays a pivotal role in various industries, from construction to electronics. This article delves into the intricacies of copper futures pricing, providing you with a detailed and multi-dimensional perspective.

Market Dynamics

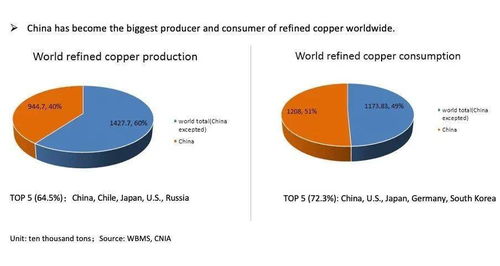

The copper futures market is influenced by a multitude of factors, including supply and demand dynamics, geopolitical events, and economic indicators. To grasp the copper futures price per ton, it is essential to understand these factors.

| Factor | Description |

|---|---|

| Supply | Supply disruptions, such as mining strikes or natural disasters, can significantly impact copper prices. |

| Demand | Increased demand from industries like construction and electronics can drive up copper prices. |

| Geopolitical Events | Political instability in copper-producing countries can lead to supply disruptions and affect prices. |

| Economic Indicators | Macroeconomic factors like GDP growth, inflation, and interest rates can influence copper prices. |

Historical Price Trends

Examining historical price trends can provide valuable insights into the copper futures market. Let’s take a look at some key trends over the past decade.

Over the past decade, the copper futures price per ton has experienced significant volatility. In 2011, the price reached a peak of around $9,000 per ton, driven by strong demand and supply concerns. However, the price subsequently declined to around $6,000 per ton in 2015. Since then, the price has fluctuated within a range of $6,000 to $8,000 per ton.

Market Participants

The copper futures market is populated by various participants, each with their own motivations and strategies. Understanding these participants can help you gain a better understanding of the market dynamics.

- Producers: Copper producers, such as mining companies, are key players in the market. They often hedge their production to protect against price volatility.

- Consumers: Industries that rely on copper, such as construction and electronics, are significant consumers of copper futures. They use futures contracts to manage their price risk.

- Traders: Speculative traders participate in the market, aiming to profit from price movements. They often have no direct interest in the physical commodity.

- Investors: Investors may invest in copper futures as a way to diversify their portfolios or speculate on price movements.

Trading Strategies

Successful trading in the copper futures market requires a well-defined strategy. Here are some common trading strategies:

- Technical Analysis: Traders use technical analysis to identify patterns and trends in historical price data.

- Fundamental Analysis: Investors analyze economic indicators, supply and demand factors, and geopolitical events to make informed decisions.

- Options Trading: Options provide traders with the flexibility to speculate on price movements without taking on the full risk of owning the physical commodity.

Regulatory Environment

The copper futures market is regulated by various authorities to ensure fair and transparent trading. In the United States, the Commodity Futures Trading Commission (CFTC) oversees the market. Other countries have their own regulatory bodies, such as the Financial Conduct Authority (FCA) in the United Kingdom.

Conclusion

Understanding the copper futures price per ton requires a comprehensive understanding of market dynamics, historical trends, market participants, trading strategies, and the regulatory environment. By staying informed and utilizing a well-defined strategy, you can navigate the complexities of the copper futures market and potentially achieve profitable outcomes.