In this article, we will explore the current landscape of currency trading, focusing on recent trends, factors influencing market movements, and tips for investors to navigate today’s financial environment. Understanding the dynamics of currency exchange rates is essential for anyone involved in trading or investing.

Key Factors Influencing Currency Values

Several elements contribute to the fluctuations in currency rates. Economic indicators such as inflation, interest rates, and employment data play a significant role. For instance, a country with a strong economic performance is likely to see its currency strengthen against others.

Political stability is another crucial factor. Investors prefer to trade in currencies from politically stable nations, as uncertainty can lead to volatility. Moreover, central banks’ actions regarding monetary policy significantly impact currency values. If a central bank raises interest rates, its currency typically becomes more attractive to foreign investors, resulting in an appreciation of its value.

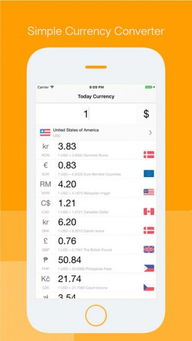

Today’s Currency Trends

As of today, several currency pairs have shown notable activity in the foreign exchange market. The USD/EUR pair has continued to see fluctuations, influenced by the European Central Bank’s decisions and the economic recovery in the U.S. Meanwhile, emerging market currencies are gaining attention as they rebound from previous dips.

Traders are particularly watching the GBP/USD exchange rate, which has shown volatility due to ongoing discussions regarding trade agreements and political developments in the UK. Additionally, the market has reacted to news about geopolitical tensions, which often lead to safe-haven assets like the Swiss Franc gaining strength.

Investment Tips for Navigating the Currency Market

Investors looking to engage in currency trading today should consider several strategies. Firstly, keeping abreast of global economic news and forecasts can help anticipate market movements. Utilizing technical analysis can also provide insights into potential trends and reversal points in currency prices.

Moreover, diversifying one’s trading portfolio can mitigate risks associated with currency fluctuations. Understanding the specific factors influencing each currency pair allows traders to make informed decisions, whether they are looking for short-term profits or long-term investments.

In summary, the currency market remains dynamic and influenced by a variety of factors, including economic performance, political stability, and market sentiment. By staying informed and employing sound trading strategies, investors can navigate today’s challenges and seize potential opportunities in currency trading.