Ton Tes Chart: A Comprehensive Guide

Are you curious about the Ton Tes Chart and how it can help you make informed decisions? Look no further! In this detailed guide, I’ll take you through the ins and outs of the Ton Tes Chart, covering its various dimensions and applications. Whether you’re a seasoned investor or just starting out, this article will provide you with the knowledge you need to understand and utilize the Ton Tes Chart effectively.

Understanding the Ton Tes Chart

The Ton Tes Chart is a powerful tool that combines technical analysis with fundamental analysis to provide a comprehensive view of a stock’s performance. It’s designed to help investors identify potential buying and selling opportunities by analyzing various factors such as price, volume, and market sentiment.

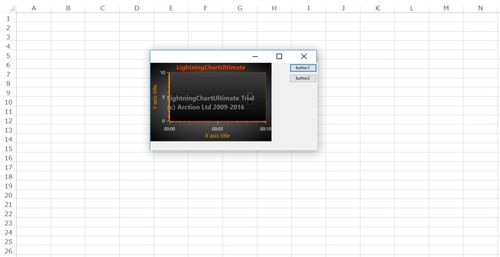

At its core, the Ton Tes Chart consists of three main components: the price chart, the volume chart, and the indicator chart. Let’s take a closer look at each of these components.

The Price Chart

The price chart is the most basic and essential part of the Ton Tes Chart. It displays the historical price movements of a stock over a specific period, typically in the form of a line graph or a bar chart. By analyzing the price chart, you can identify trends, support and resistance levels, and potential reversal points.

Here are some key elements to consider when examining the price chart:

- Trends: Upward trends indicate that the stock is gaining momentum, while downward trends suggest that the stock is losing momentum.

- Support and Resistance: These are price levels where the stock has repeatedly struggled to move above or below. They can be used to predict future price movements.

- Reversal Points: These are points where the stock’s price changes direction, indicating a potential shift in market sentiment.

The Volume Chart

The volume chart shows the trading volume of a stock over a specific period. It’s an essential component of the Ton Tes Chart because it provides insight into the strength of a stock’s price movements. High volume often indicates strong market sentiment, while low volume may suggest a lack of interest or uncertainty.

Here are some key elements to consider when examining the volume chart:

- Volume Trends: Similar to price trends, volume trends can indicate the strength of a stock’s price movements.

- Volume Spikes: Sudden increases in volume can signal significant market sentiment changes, such as a breakout or breakdown.

- Volume Dips: Sudden decreases in volume can indicate a lack of interest or uncertainty in the stock.

The Indicator Chart

The indicator chart is where the Ton Tes Chart truly shines. It combines various technical indicators to provide a more in-depth analysis of a stock’s performance. Some popular indicators include moving averages, relative strength index (RSI), and Bollinger Bands.

Here are some key indicators to consider when examining the indicator chart:

- Moving Averages: These indicators help identify the trend direction and strength by smoothing out price data over a specific period.

- Relative Strength Index (RSI): This indicator measures the speed and change of price movements, helping to identify overbought or oversold conditions.

- Bollinger Bands: These indicators consist of a middle band, an upper band, and a lower band, providing a range for price movements and identifying potential reversal points.

Using the Ton Tes Chart in Practice

Now that you understand the components of the Ton Tes Chart, let’s look at how you can use it in practice.

1. Identify Trends: By analyzing the price and volume charts, you can identify the overall trend of a stock. If the stock is in an upward trend with increasing volume, it may be a good buying opportunity.

2. Find Reversal Points: By examining the indicator chart, you can identify potential reversal points where the stock’s price may change direction. For example, if the RSI indicator shows an overbought condition, it may indicate a potential reversal to the downside.

3. Combine Indicators: Use multiple indicators to confirm your analysis. For instance, if the price chart shows a potential reversal point and the RSI indicator confirms an overbought condition, it may be a strong signal to sell.

4. Monitor Market Sentiment: Keep an eye on the indicator chart to gauge market sentiment.